-

Amicus Brief on Borrower Defense Rule

We filed a brief in the U.S. District Court for the Southern District of New York supporting a challenge to the Department of Education’s replacement for a 2016 regulation known as the Borrower Defense Rule. The replacement rule makes it much harder for student borrowers who have been defrauded by for-profit colleges to get their loans discharged. We later filed a brief in the Second Circuit Court of Appeals after SDNY upheld the rule.

-

Petition for Rulemaking for the Federal Trade Commission to Ban Drip Pricing

Drip pricing is a strategy used by some sellers to lure in consumers by advertising deceptively low prices, only to reveal hidden mandatory fees after the consumer is on the verge of completing a transaction. We submitted a petition to the Federal Trade Commission formally calling for a new rule banning the use of drip pricing.

-

Comments to New York PSC on Climate Change Vulnerability Assessments

We submitted comments to the New York Public Service Commission to voice our support for a petition concerning the impacts of climate change on utility infrastructure. Our comments emphasize that it is imperative for public utilities to identify and assess the risks that climate change poses to their assets and operations.

-

Comments to SEC on Climate Change Disclosure

Climate change presents grave risk across the U.S. economy, including to corporations, their investors, the markets in which they operate, and the American public at large. The Securities and Exchange Commission (SEC) recently requested public input on climate change disclosures, posing several questions related to the development of new disclosure regulations and the enforcement of existing regulations. We worked with several partners to submit comments to the SEC, providing 15 major recommendations.

-

Policy Integrity and Partners Form New Initiative on Climate Risk and Resilience Law

As the climate crisis intensifies, it is crucial that policymakers strengthen protections from the dangers of climate change to our nation’s financial system and the millions of people who rely on it to sustain the American economy. The Institute for Policy Integrity, alongside several partners, has founded the Initiative on Climate Risk and Resilience Law to advocate for smarter policies on this issue.

-

Tune Up

Fixing Market Failures to Cut Fuel Costs and Pollution from Cars and Trucks

This report analyzes a key issue in U.S. transportation policy: the energy efficiency gap. We discuss the market failures that cause it, and recommend that the Biden administration continue the longstanding practice of incorporating private fuel savings in any evaluation of the costs and benefits of stronger standards for cars and trucks.

-

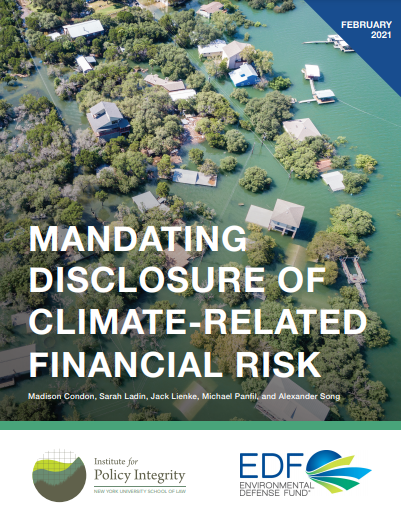

Comments to Federal Finance Housing Agency on Climate Risk Disclosure

The Federal Housing Finance Agency requested information on the risks that climate change and natural disasters pose to the housing finance system. We submitted short comments and attached our report with the Environmental Defense Fund, Mandating Disclosure of Climate-Related Financial Risk, which surveys the variety of risks that U.S. corporations, including those in the housing sector, face from climate change’s physical effects and policy and market consequences.

-

McTeer Toney Gives Testimony on Climate Risk Disclosure in House Committee Hearing

Heather McTeer Toney, Climate Justice Liaison for the Environmental Defense Fund and Senior Advisor to Moms Clean Air Force, testified in a hearing on corporate climate risk held by the House Financial Services Committee. Included with her submitted testimony is our report with the Environmental Defense Fund on how the Securities and Exchange Commission can issue new, mandatory disclosure rules focused on climate risk.

-

Mandating Disclosure of Climate-Related Financial Risk

Climate change presents grave risk across the U.S. economy, including to corporations, their investors, the markets in which they operate, and the American public at large. Unlike other financial risks, however, climate risk is not routinely disclosed to the public. This report, authored by Policy Integrity and the Environmental Defense Fund, urges the Securities and Exchange Commission to issue new, mandatory disclosure rules focused on climate risk.

-

Corporate Climate Risk: Assessment, Disclosure, and Action

Conference Brief

On October 2, 2020, the Institute for Policy Integrity and the Volatility and Risk Institute at NYU Stern School of Business convened a conference bringing together investors, companies, researchers, and regulators to discuss climate-related financial risks and identify opportunities to better assess, report, and act on them. This brief summarizes some of the major points of discussion from the conference, which featured different perspectives on various policy, economic, and legal issues.

Viewing recent projects in Consumer and Healthcare Protection