-

Comments to Connecticut on Energy Storage and Emissions

The Connecticut Public Utilities Regulatory Authority (PURA) issued a straw program design for electric storage. We submitted comments that support PURA's efforts to make energy storage part of its overarching decarbonization agenda and provide feedback. It is important, as we explain, that PURA take into account the potential emissions consequences of energy storage operations in designing its performance-based incentive.

-

The Public Interest Review for LNG-Related Authorizations

After a meteoric rise in production over the past decade, the United States has become the largest exporter of liquefied natural gas (LNG) in the world. Yet, the analysis behind LNG terminal and export approvals overlooks climate and environmental justice impacts, despite promises of imminent reform. Policy Integrity’s new report provides a comprehensive look at the Department of Energy’s (DOE) and the Federal Energy Regulatory Commission’s (FERC) past practice in this space and offers recommendations for improving their review of the climate and environmental justice impacts of LNG approvals.

-

The Social Cost of Greenhouse Gases: A Guide for State Officials

As states step up on climate action, they need a way to weigh climate goals against other policy objectives. The social cost of greenhouse gases (SC-GHG) can help policymakers understand the costs and benefits of climate action and inaction. This new guide for state officials explains why the SC-GHG is a useful policy tool and how it can be applied.

-

Comments to DOE on Supplemental Environmental Analysis for Alaska LNG Project

After the Department of Energy published a supplemental environmental impact statement claiming that exporting liquefied natural gas from a proposed Alaska terminal would decrease greenhouse gas emissions, we submitted comments challenging the Department’s methodology and assumptions. In particular, our comment letter explains that the Department’s analysis unreasonably assumes that the Project would merely displace existing exports from Gulf Coast facilities, and thus overlooks the inevitable economic reality that the Project will increase total natural gas supply and consumption. As our comment letter explains, courts have rejected this “perfect substitution” assumption in related contexts. Moreover, our letter explains that the Department’s lifecycle analysis insufficiently considers the choice of destination countries and is inconsistent with the agency’s analysis of economic impacts.

-

Amicus Brief in Support of Upholding PJM’s Focused Minimum Offer Price Rule

Last July, PJM Interconnection (the electricity grid operator for 13 states and the District of Columbia) submitted revisions to its Minimum Offer Price Rule (MOPR) for its capacity market to the Federal Energy Regulatory Commission (FERC) for approval. The new rule (the “Focused MOPR”) would remove an artificial barrier to market entry for resources that receive such externality payments under state climate and clean energy policies. Policy Integrity filed an amicus brief in support of FERC and PJM’s Focused MOPR explaining why the rule is welfare-enhancing and would not threaten reliability.

-

Comments on the New York Climate Action Council’s Draft Scoping Plan

The Climate Leadership and Community Protection Act (CLCPA or the Act) committed New York to an ambitious set of changes across all sectors of the economy. The development of a Scoping Plan, as called for by the Act, will help steer New York's agencies--and legislature--as they initiate those changes. Policy Integrity's comments focus on the Electricity and Gas System Transition chapters of the Draft Scoping Plan. In addition to voicing support for several of the measures listed in that plan, those comments encourage adoption of further measures in a final version of the plan. Those additional measures would support greater coordination of electricity sector stakeholders' decisions and would create a greater degree of certainty about the nature and pace of gas system transition.

-

Joint Comments to SEC on its Proposal to Enhance and Standardize Climate-Related Disclosures

Together with the Environmental Defense Fund and Professor Madison Condon of Boston University School of Law, we submitted three sets of comments to the Securities and Exchange Commission (SEC) in support of its Proposed Rule on the Enhancement and Standardization of Climate-Related Disclosures for Investors (Proposed Rule). The Proposed Rule would require publicly traded companies to disclose important information about the extent to which climate change is already affecting their financial performance, their approach to climate-related risk management, their climate-relevant governance structures, and their greenhouse gas emissions, which serve as a proxy for exposure to risk from policy- and market-driven shifts to a clean-energy economy.

-

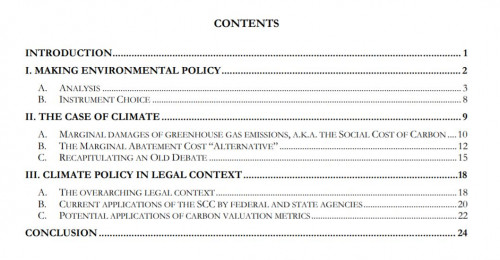

Costs, Confusion, and Climate Change

Yale Journal on Regulation

Recently, some prominent public policy experts and scholars have proposed that a “marginal abatement cost” (MAC) could be used as an alternative to the social cost of carbon (SCC). This article provides conceptual clarity about these metrics, focusing on how a MAC-based threshold could sensibly be used in climate policy, and explaining why it is not a substitute for the SCC.

-

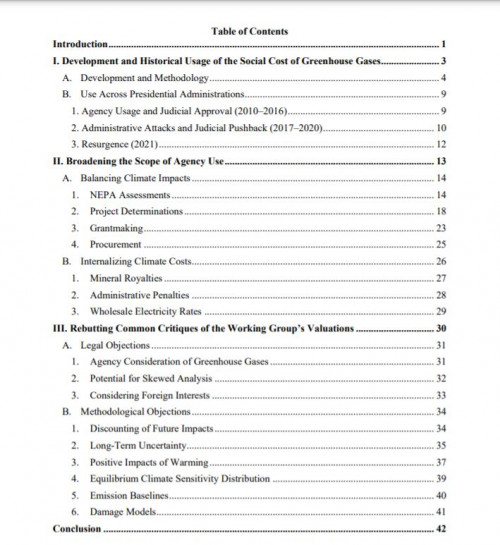

The Social Cost of Greenhouse Gases: Legal, Economic, and Institutional Perspective

Yale Journal on Regulation

The social cost of greenhouse gases provides the best available method to quantify and monetize incremental climate damages. To date, however, the use of the method for such determinations and processes has been sporadic and fairly limited. Published in the Yale Journal on Regulation, this article evaluates the various legal, economic, and institutional controversies surrounding the social cost of greenhouse gases, and explains why this metric should play a critical role in guiding agency policymaking and decision-making related to climate change.

-

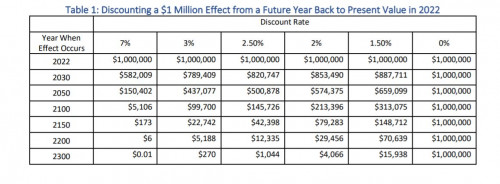

Valuing the Future: Legal and Economic Considerations for Updating Discount Rates

Yale Journal on Regulation

This article explores the legal and economic considerations for updating discount rates and details the compelling economic evidence for lowering the current default rates for regulatory analyses. It argues that a declining discount rate framework can consistently harmonize agency practices and so put agencies on sound legal footing in their approach to valuing the future.

Viewing recent projects in Climate and Energy Policy