-

Comments to FERC on Transmission NOPR

We submitted comments to FERC providing recommendations for how it can clarify and improve reforms proposed in its Notice of Proposed Rulemaking addressing transmission planning and cost allocation. If finalized, the rulemaking would require planning entities to undertake long-term transmission planning. Our comments recommend that FERC clarify (at a high level) what it means to undertake long-term planning over a 20-year time horizon. We also recommend more specific improvements that can be made, including providing minimum uniform requirements on model specifications and scenario planning based on best practices; instituting administrative guardrails to protect transmission customers from excessive costs if the Commission moves forward with its proposed Right of First Refusal; and mandating a uniform set of core benefits that all planners must consider.

We also submitted reply comments in the proceeding to underscore two points. In response to commenters that argued the Commission should reconsider its proposal in light of the level of uncertainty surrounding the future, we argue that it is future uncertainty that necessitates the long-term scenario planning contemplated by the rule. Such proactive transmission planning will allow planners to prepare for and react to changing circumstances and ensure a reliable and resilient grid in the face of uncertainty. Additionally, our reply comments reaffirm previous recommendations that the Commission should require planners to use a standardized cost-benefit analysis that properly accounts for societal benefits of new transmission.

-

Comments to SEC on ESG Disclosures

The SEC has proposed a series of new disclosures for investment companies regarding their Environmental, Social, and Governance (ESG) activities. These disclosures would reduce "greenwashing" - a practice where companies misrepresent the sustainability of their investments in order to advertise to investors looking to invest in green funds - by providing investors with comparable and decision-useful information about fund practices. We submitted comments on the SEC's economic analysis of the Proposed Rule. We commend the Commission for complying with relevant case law and internal guidance on cost-benefit analysis and recommend steps that the SEC could take in the final rule to provide additional clarity and context regarding its findings.

-

Comments to SEC on Investment Company Names

The SEC has proposed a rule that would better align the names of investment companies with investor expectations, including for Environmental, Social, and Governance (ESG) investment funds, by requiring portfolio distribution requirements for funds whose name connotes a particular investment strategy. We submitted comments on the SEC's economic analysis of the Proposed Rule. We commend the Commission for complying with relevant case law and internal guidance on cost-benefit analysis and recommend steps that the SEC could take in the final rule to provide additional clarity and context regarding its findings.

-

Comments to DOE on Supplemental Environmental Analysis for Alaska LNG Project

After the Department of Energy published a supplemental environmental impact statement claiming that exporting liquefied natural gas from a proposed Alaska terminal would decrease greenhouse gas emissions, we submitted comments challenging the Department’s methodology and assumptions. In particular, our comment letter explains that the Department’s analysis unreasonably assumes that the Project would merely displace existing exports from Gulf Coast facilities, and thus overlooks the inevitable economic reality that the Project will increase total natural gas supply and consumption. As our comment letter explains, courts have rejected this “perfect substitution” assumption in related contexts. Moreover, our letter explains that the Department’s lifecycle analysis insufficiently considers the choice of destination countries and is inconsistent with the agency’s analysis of economic impacts.

-

Amicus Brief in Support of Upholding PJM’s Focused Minimum Offer Price Rule

Last July, PJM Interconnection (the electricity grid operator for 13 states and the District of Columbia) submitted revisions to its Minimum Offer Price Rule (MOPR) for its capacity market to the Federal Energy Regulatory Commission (FERC) for approval. The new rule (the “Focused MOPR”) would remove an artificial barrier to market entry for resources that receive such externality payments under state climate and clean energy policies. Policy Integrity filed an amicus brief in support of FERC and PJM’s Focused MOPR explaining why the rule is welfare-enhancing and would not threaten reliability.

-

Joint SC-GHG Comments on Commercial Water Heating Equipment

Together with partner groups, we submitted joint comments to the Department of Energy (DOE) on its proposed rule to strengthen energy conservation standards for commercial water heating equipment. Our comments applaud the agency for appropriately applying the social cost of greenhouse gases to estimate the climate benefits of the proposed standards, even though the standards would be cost-benefit justified without considering any climate benefits. We also encourage DOE to expand upon its rationale for adopting a global damages valuation and for the range of discount rates it applies to climate effects.

-

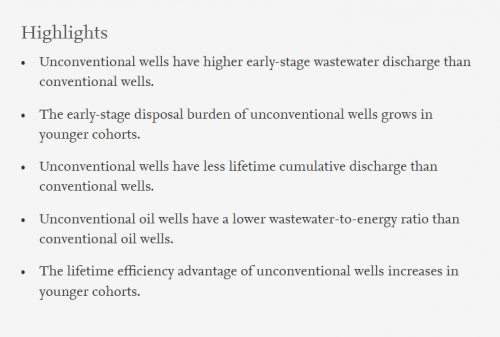

Does Unconventional Energy Extraction Generate More Wastewater? A Lifetime Perspective

Published in Ecological Economics

The paper analyzes how wastewater generation patterns differ between unconventional wells and conventional wells, accounting for differences in well configurations and local geology. Using the 2008–2016 monthly production data from 50,039 wells, the authors show that unconventional wells generated more wastewater in the first 12 months of production but less cumulative discharge than conventional wells. Unconventional oil wells had a lower wastewater-to-energy ratio throughout their lifetime than their conventional counterparts, whereas no efficiency gap existed among gas wells. These findings call for targeted strategies to balance the short-term disposal burden and the long-term efficiency gains of unconventional energy extraction.

-

Comments to EPA on its Proposed Asbestos Risk Management Rule

The Environmental Protection Agency (EPA) has proposed a ban on multiple conditions of use of chrysotile asbestos. The Institute for Policy Integrity and Professor Rachel Rothschild at the University of Michigan Law School submitted comments on the agency’s economic analysis of the proposed rule, identifying numerous ways EPA underestimated the health benefits from reduced cancer cases and lung illnesses and could strengthen the robust scientific, economic and legal basis for EPA’s proposed rule.

-

Comments on the New York Climate Action Council’s Draft Scoping Plan

The Climate Leadership and Community Protection Act (CLCPA or the Act) committed New York to an ambitious set of changes across all sectors of the economy. The development of a Scoping Plan, as called for by the Act, will help steer New York's agencies--and legislature--as they initiate those changes. Policy Integrity's comments focus on the Electricity and Gas System Transition chapters of the Draft Scoping Plan. In addition to voicing support for several of the measures listed in that plan, those comments encourage adoption of further measures in a final version of the plan. Those additional measures would support greater coordination of electricity sector stakeholders' decisions and would create a greater degree of certainty about the nature and pace of gas system transition.

-

Enhancing Consideration of Time Frames in Cost-Benefit Analysis

Federal agencies frequently provide no justification for their analytical time frame when analyzing the costs and benefits of a policy. This is true even when there are costs and benefits that clearly occur beyond the time frame chosen by the agency. In so doing, agencies risk overlooking key long-term impacts that may justify more stringent regulation.

This report argues that the Office of Management and Budget (OMB) should take steps to improve how agencies consider analytical time frames in their cost-benefit analyses.